Between market volatility, increased longevity, and inflation, the fear of running out of money in retirement is a sentiment that is on the forefront of any clients’ concerns over the financial stability of their golden years. And rightfully so. It is far too common that a lack of proper planning contributes to an unnecessary loss of funds that impacts the standard of living for the client, and their ability to maximize wealth transfers to their heirs. When market conditions take a downturn, financial professionals traditionally advise clients to simply live on less. But is that really what your clients want or what we should plan for?

Financial uncertainty and economic downturn are not questions of if it will happen, but rather of when it will happen.

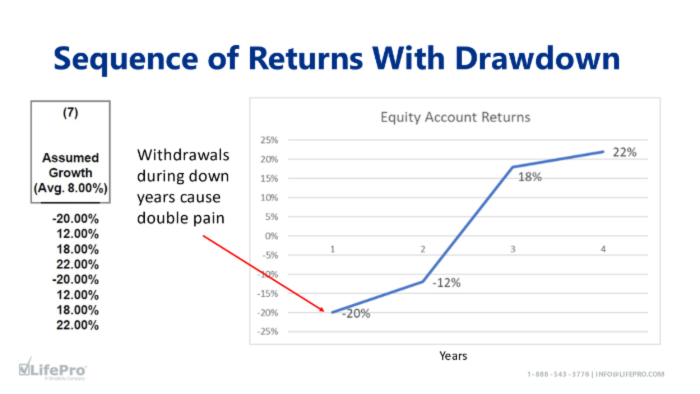

It’s time to stop reacting to issues as they arise and start preventing them before they occur. One way to accomplish this, is to incorporate a ‘volatility buffer’ into your clients’ financial plans. During the accumulation years, the sequence of returns does not create a huge risk for clients. In fact, it could create opportunities to buy high quality stocks at a discounted price when the stock market turns negative. However, during the distribution years, large account losses coupled with withdrawals can cause double pain for retirees. Taking account withdrawals during down years has the potential to lock in losses and restrict the account’s recovery.

With that in mind, we can consider creating a ‘volatility buffer’ during our clients’ retirement years. To do this we can max fund an Indexed Universal Life policy during a client’s working years. Rather than utilizing the IUL for systematic, level income during retirement, we can instead take policy loans during down years in the stock market. By doing so we do not have to tap into investment accounts and incur the double pain associated with losses and withdrawals.

Since the IUL loan is tax-free, it can also allow for other strategic opportunities. For example, if most of a client’s income was coming from the IUL, their taxable income would be substantially less than other tax years. This may be an ideal situation for a partial Roth IRA conversion, especially after a market pullback.

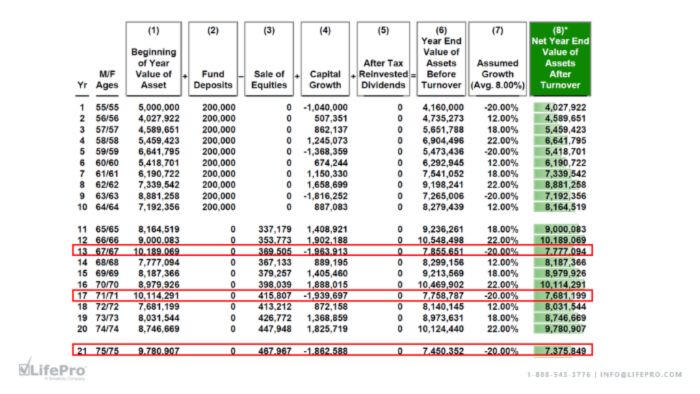

To illustrate this concept, I have a client with $5 million in a non-qualified equity account averaging 8% per year. The random investment sequence is: -20%, 12%, 18%, 22%. I repeat this sequence every 4 years.

Source: LifePro Financial, Inc. Hypothetical situation for illustration purposes only. See disclosure for more information.

The client is currently contributing $200k a year to this investment account for the next 10 years while working. The current plan shows the equity account drain down substantially during the retirement years, especially during those down years coupled with taking income.

Source: InsMark. Hypothetical situation for illustration purposes only. See disclosure for more information.

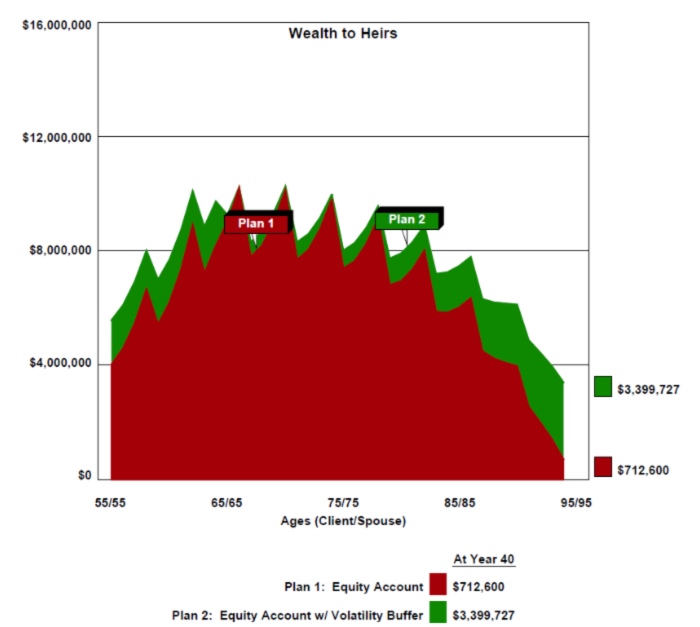

For the proposed plan, I am simply redirecting 70% of the taxable account contributions, or $140k a year, for 10 years into the IUL with a 6% illustrated rate. As opposed to being solely reliant on the investment account for income, I am instead taking loans from the IUL for income during down market years. This allows the equity account to recover without interruption by distributions for income, thus avoiding double pain and providing more net worth/wealth to heirs.

Source: InsMark. Hypothetical situation for illustration purposes only. See disclosure for more information.

Imagine if this were the type of difference you could make for your clients. This is not only a huge win for the client, but also a big benefit to the investment advisor’s business by maintaining more AUM and more consistent revenue. Creating financial success such as this for your clients is creating success for yourself as well. Increasing the wealth transfer for heirs, or preventing unnecessary losses before then, allows the investment advisor to retain more AUM by having another account to take income from during bear markets.

By now it’s clear how beneficial it is to incorporate a ‘volatility buffer’ into your clients’ complete and holistic financial plans. The goal of sharing the very same strategies that we use with you is to encourage you to expand how you consider responding to your clients’ various needs. It’s not only unrealistic and simplistic to tell clients to just “live on a tighter budget,” but also unfair for financial professionals to resort to when more sound solutions exist. At LifePro, we have a highly skilled and experienced in-house Advanced Case Design Department that frequently uses these strategies when providing our thousands of advisors from across the country who outsource their paraplanning to us. To learn more about how we can help you better service your clients to help grow your business, please reach out to us at 888-543-3776.

Additional Resources

Contact LifePro Today!

If you are looking for a partner who cares about your clients as much as you do, please reach out to LifePro Financial Services at 888-543-3776. We are a premier IMO located in San Diego, CA that has been in business since 1986 and was originally founded by Bill Zimmerman.

Our focus is getting advisors in front of the right prospects through our proprietary digital marketing systems while offering industry best-case design and reporting, professional back-office support, and competitive compensation with incentives.

Investments have risk. Past performance is not indicative of future results. This material is for educational purposes only. Any reference to index universal life used in this material is hypothetical and is intended solely to show how IULs may be used with this planning concept. This example is for discussion purposes only. Actual results will vary based on your specific situation. Certain assumptions are based on information provided by you. Consult your own tax and/or legal advisor(s) when making tax and legal decisions. Investment and insurance values are illustrative/projective only, not guarantees. A personalized basic IUL illustration/projection is required which includes product features and any guarantees. Investment advisory and financial planning services offered through LifePro Asset Management, an SEC Registered Investment Advisor. Registration does not imply a certain level of skill or training. Investments involve risk. Insurance, consulting, and education services are offered through LifePro Financial Services, Inc.