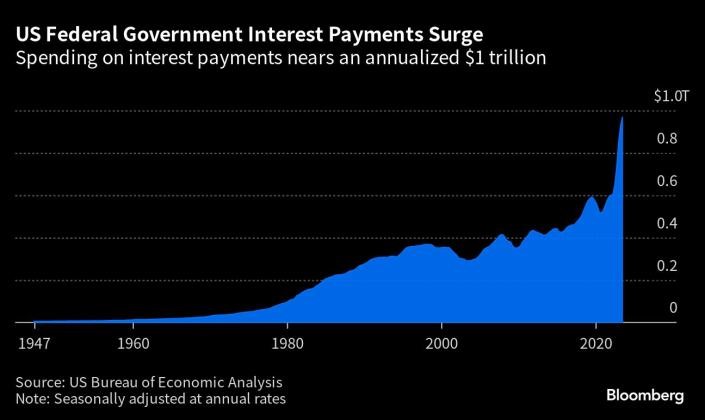

In breaking financial news, Fitch has downgraded their U.S. credit rating from AAA to AA+. The only other time that the U.S. has been cut from its highest AAA rating was by S&P in 2011, which attributed budget standoff issues and a prolonged fight over the government's borrowing limit as determining factors. Following this, the Government Accountability Office released a 2012 report that estimated that those standoffs raised the Treasury's borrowing costs by $1.3 billion that year.

Looking at the most recent rating adjustment from Fitch and their report of driving factors, current considerations are reminiscent of those from the S&P demotion as "repeated debt limit standoffs and last-minute resolutions" were driving factors of Fitch's rating score.

After Fitch's public announcement yesterday, mixed responses have flooded the finance world. While the Secretary of the Treasury, Janet Yellen, outright disagrees with what she calls an "arbitrary" and "outdated" rating system, others such as Treasury spokesperson, Lily Adams, claim that the demotion is indicative of the larger need for "swift bipartisan action" on Congress's behalf to avoid economic crisis.

As this news makes its way into your inboxes and onto your newsfeeds, we want to remind you that we are here to support you during these turbulent times. We invite you to reach out to your FSR at (888) 543-3776 who can help provide strategies to reduce the risks associated with higher future tax rates and stock market volatility as the U.S. continues to lead the charge in public debt as a percentage of GDP.

Contact LifePro Today!

If you are looking for a partner who cares about your clients as much as you do, please reach out to LifePro Financial Services at 888-543-3776. We are a premier IMO located in San Diego, CA that has been in business since 1986 and was originally founded by Bill Zimmerman.

Our focus is getting advisors in front of the right prospects through our proprietary digital marketing systems while offering industry best-case design and reporting, professional back-office support, and competitive compensation with incentives.

This material is intended for educational purposes only and is not intended to serve as the basis for any purchasing decision. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. The hypothetical example is shown for illustrative purposes only and is not guaranteed. The characters in this example are fictional only. Your actual experience will vary. Policy loans and withdrawals will reduce available cash values and death benefits and may cause the policy to lapse or affect any guarantees against lapse. Remember to consider your client's individual circumstances and objectives when discussing their specific situation. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of the unrecovered cost basis will be subject to ordinary income tax. Withdrawals are generally income tax-free unless the withdrawal amount exceeds the amount of premium paid. Tax laws are subject to change. Clients should consult their tax professionals. Investment advisory and financial planning services are offered through LifePro Asset Management, an SEC Registered Investment Advisor. Registration does not imply a certain level of skill or training. Investments involve risk.